Latest from blog

Halal Food

- All

- Advertorial

- Air Itam

- American Food

- Ampang

- App / Website Review

- Bak Kut Teh

- Bali

- Balik Pulau

- Bandar Sunway

- Bangkok

- Bangsar

- Batu Caves

- Bayan Baru

- Bayan Lepas

- Blogging

- Buffet

- Bukit Bintang

- Bukit Mertajam

- Bukit Tambun

- Burger

- Butterworth

- Cafe

- Cambodia

- Cameron Highlands

- Cheras

- Cheras

- Chiang Mai

- Chinese Food

- Cyberjaya

- Damansara Heights (Bukit Damansara)

- Damansara Jaya

- Damansara Utama

- Dim Sum

- Dubai

- Durian

- E-Gate

- Europe & UK

- Event

- Featured

- Food Court

- Food Guide

- Freebies & Contest

- Genting Highlands

- George Town

- Gombak

- Gurney Drive

- Halal

- Hanoi

- Happy Garden (Taman Gembira)

- Hawker Food (Street Food)

- Hong Kong

- Hong Kong Style

- Hotel Review

- Hua Hin

- Indian Food

- Indonesian Food

- Ipoh

- Japan

- Japanese Food

- Jinjang

- Johor

- Kajang

- Kampung Baru

- Kampung Sungai Penchala

- Kepong

- Klang

- KLCC

- Kopitiam Style

- Korean Food

- Kota Damansara

- Kota Kinabalu

- Kuala Lumpur

- Kuantan

- Kuchai Lama

- Kuching

- Lang Tengah Island

- Langkawi Island

- List

- Location

- Macau

- Malay Food

- Malaysia

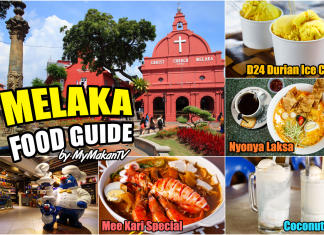

- Melaka

- Misc

- Mont Kiara

- Muar

- Negeri Sembilan

- Nilai

- Non Halal

- Pahang

- Pattaya

- Pavilion KL

- Penang

- Perai

- Perak

- Petaling Jaya

- Petaling Street

- Photography

- Phuket

- Pork Free

More

5 Restaurants You Must Try in Bandar Bukit Puchong

Bandar Bukit Puchong used to be my home for almost two years. I rented a place in Nilam Puri Condominiums when I was working...

Durian Cendol @ Rojak & Cendol Shah Alam, Seksyen 24 Shah...

We are not at the peak season of durian yet, but the fever for the King of the Fruits is hotter more than ever now. Durian cendol is not a new thing in Malaysia but a rojak & cendol stall in Shah Alam decided to take it it further by adding real and fresh durian fruits (never frozen) in their cendol. So essentially it's not durian cendol. Instead, it's durian in cendol.

Ee Ji Ban Chicken Rice Ball Restaurant @ Melaka

During our last trip to Melaka, we stumbled into a new place for chicken rice. The restaurant is called 'Ee Ji Ban' and they appear to be Muslim friendly too as various Malay celebrities have eaten here before. And since it's located in Melaka, you can expect to find chicken rice balls in the menu too.

Non Halal Food

- All

- Advertorial

- Air Itam

- American Food

- Ampang

- App / Website Review

- Bak Kut Teh

- Bali

- Balik Pulau

- Bandar Sunway

- Bangkok

- Bangsar

- Batu Caves

- Bayan Baru

- Bayan Lepas

- Blogging

- Buffet

- Bukit Bintang

- Bukit Mertajam

- Bukit Tambun

- Burger

- Butterworth

- Cafe

- Cambodia

- Cameron Highlands

- Cheras

- Cheras

- Chiang Mai

- Chinese Food

- Cyberjaya

- Damansara Heights (Bukit Damansara)

- Damansara Jaya

- Damansara Utama

- Dim Sum

- Dubai

- Durian

- E-Gate

- Europe & UK

- Event

- Featured

- Food Court

- Food Guide

- Freebies & Contest

- Genting Highlands

- George Town

- Gombak

- Gurney Drive

- Halal

- Hanoi

- Happy Garden (Taman Gembira)

- Hawker Food (Street Food)

- Hong Kong

- Hong Kong Style

- Hotel Review

- Hua Hin

- Indian Food

- Indonesian Food

- Ipoh

- Japan

- Japanese Food

- Jinjang

- Johor

- Kajang

- Kampung Baru

- Kampung Sungai Penchala

- Kepong

- Klang

- KLCC

- Kopitiam Style

- Korean Food

- Kota Damansara

- Kota Kinabalu

- Kuala Lumpur

- Kuantan

- Kuchai Lama

- Kuching

- Lang Tengah Island

- Langkawi Island

- List

- Location

- Macau

- Malay Food

- Malaysia

- Melaka

- Misc

- Mont Kiara

- Muar

- Negeri Sembilan

- Nilai

- Non Halal

- Pahang

- Pattaya

- Pavilion KL

- Penang

- Perai

- Perak

- Petaling Jaya

- Petaling Street

- Photography

- Phuket

- Pork Free

More

Steamboat Restaurants to Eat in KL & Klang Valley

Safe to say steamboat, or hot pot is more popular in Klang Valley than any other places in Malaysia. There's simply something special about...

Restoran Boston Baru 伸波士頓餐室 @ Klang

Restoran Boston Baru in Klang is notorious for its long wait time. I have heard stories where customers have waited 3 hours just to get their food served.

Last weekend, I finally said 'screw it' and came here as early as 4.45pm to be one of the earliest customers. But what do you know, I still ended up being the second in line.

5 Restaurants You Must Try in Bandar Bukit Puchong

Bandar Bukit Puchong used to be my home for almost two years. I rented a place in Nilam Puri Condominiums when I was working...